Critical Minerals, Critical Choices: Africa’s Bid to Control the Green Value Chain

For more than a decade, the global energy transition has been sold as a story of technology. We are told solar panels are getting cheaper, wind turbines are getting taller, and batteries are...

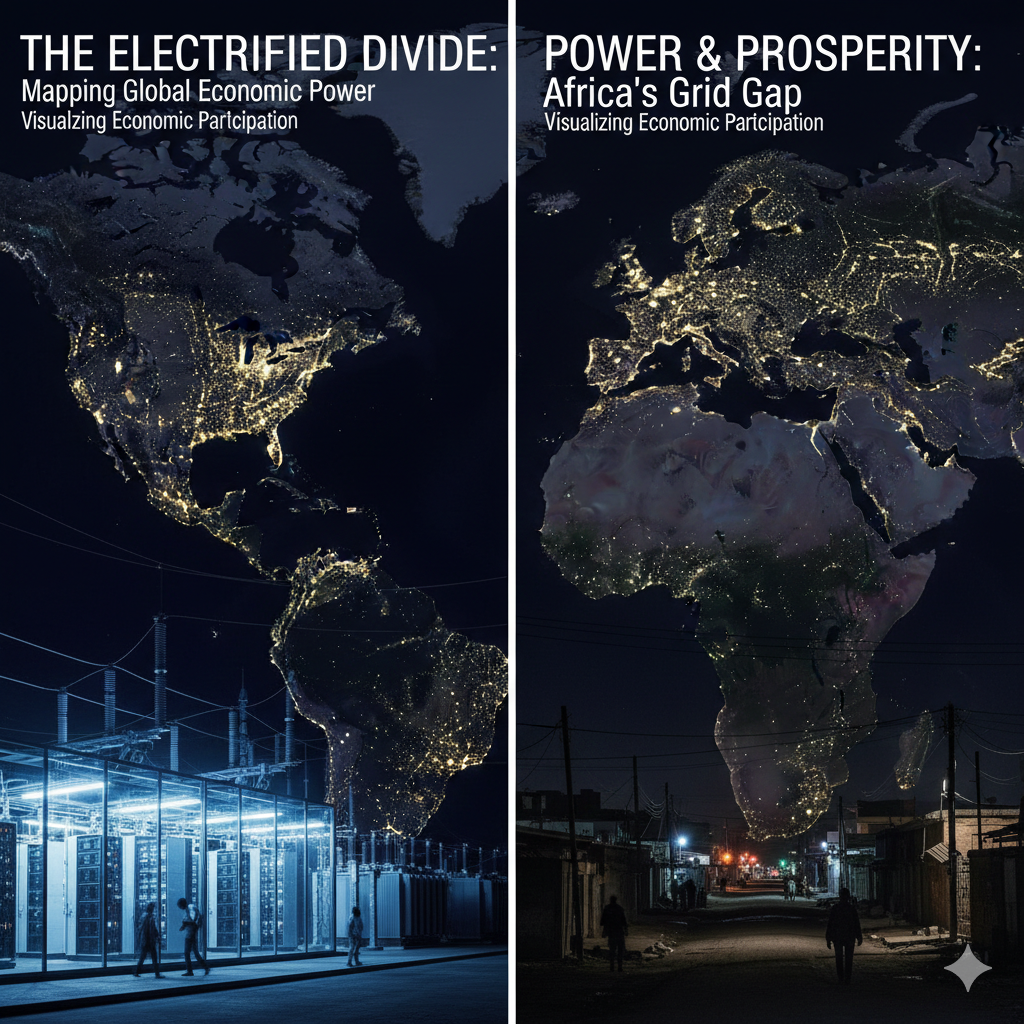

For most of modern economic history, electricity demand has followed growth. When economies expanded, electricity use rose steadily and predictably, rarely faster. That relationship is now breaking....

Africa holds the minerals the world needs. The real question is: can the continent hold the value, too?

From cobalt in the Democratic Republic of Congo to lithium in Zimbabwe, manganese in South Africa, and rare earth elements across East Africa, the continent is now at the epicentre of the global energy transition. Critical minerals are the backbone of clean energy technologies, batteries, wind turbines, solar panels, and electric vehicles.

The stakes are clear: without Africa’s resources, the world’s climate ambitions stall. Yet the bigger question is whether Africa will continue to play the role it has for centuries, supplying raw materials to the world at bargain prices, or whether it can leverage this moment to industrialise, create jobs, and retain more value at home.

Recently, the African Union (AU) moved to answer that question. Reports confirm that the AU is spearheading a coalition of African states to assert greater control over mineral value chains and prevent a repeat of past extractive models. At the same time, philanthropist Mo Ibrahim has called for a strategy to “unlock Africa’s green riches,” turning geology into genuine prosperity rather than dependency.

The momentum is real. But so are the risks.

Africa has been here before. From the gold and diamond trade of the colonial era to the oil and copper booms of the 20th century, resource abundance has rarely translated into broad-based development. Instead, much of the value was exported, while domestic economies remained undercapitalised and vulnerable to price swings.

The pattern is familiar:

This “dig, ship, repeat” model has trapped Africa in cycles of dependency. Unless governance structures change, critical minerals risk becoming the “new oil” curse, a resource that enriches a few while leaving societies exposed to environmental harm and economic volatility.

The AU’s coalition on critical minerals seeks to disrupt this pattern. By coordinating policy across countries, the bloc aims to:

If successful, the coalition could help Africa set its own terms, rather than accepting fragmented, country-by-country deals. But success will depend on overcoming political divisions, strengthening institutions, and resisting pressure from powerful external actors.

The urgency comes from outside as much as within.

All three powers are now actively courting African governments, offering infrastructure, security deals, and financing in exchange for access. For Africa, the challenge is to turn competition into leverage without surrendering sovereignty.

In his recent intervention, Mo Ibrahim put it bluntly: “Africa cannot afford to be the quarry of the green transition.” He argued that the continent’s mineral wealth must be monetised in ways that build industrial capacity, create decent jobs, and strengthen governance.

His proposals include:

These ideas echo the African Mining Vision, adopted in 2009, which called for integrated and transparent mineral development. But execution has lagged. The renewed focus on critical minerals may be the chance to revive that agenda with urgency.

Mineral wealth is only transformative if governance is strong. Yet in many countries, governance gaps persist:

These issues are not abstract. Reports from the Guardian and others highlight how financing for critical mineral mining has already contributed to deforestation, biodiversity loss, and human rights abuses, with women and children disproportionately affected.

If Africa is to capture value without repeating mistakes, governance reform must be central.

So what would capturing more value actually look like?

Examples already exist. Morocco is building a thriving renewable industry anchored in phosphate-based batteries. South Africa has long-standing platinum group metals expertise. Zimbabwe is piloting lithium processing facilities.

Scaling these efforts will require coordinated investment, infrastructure upgrades, and technical skills development.

Individual states acting alone risk falling into familiar traps. Investors often play countries against each other, extracting concessions in exchange for investment. Without regional coordination, Africa risks undercutting itself.

That is why the AU coalition is significant. By negotiating as a bloc, Africa can pursue minimum beneficiation standards, ensure fairer revenue-sharing, and prevent a destructive race to the bottom.

Still, collective action is hard. National politics, security concerns, and corruption all pose barriers. The coalition will need clear governance rules and strong political will.

Critical minerals are not just an economic issue. They are also about justice. Communities living near mines often suffer displacement, water pollution, and loss of livelihoods. Women in particular carry the costs of environmental degradation and informal labour in artisanal mining.

If Africa’s critical minerals strategy fails to address these realities, it will replicate rather than resolve injustices. A just value chain must include:

Without these, industrialisation risks becoming another elite project disconnected from people’s lives.

The world is watching Africa. The continent holds the keys to the clean energy future. But minerals alone are not destiny. Choices made now will determine whether Africa builds resilient, diversified economies or slips into another cycle of extractivism.

The AU coalition, Mo Ibrahim’s call, and civil society’s growing voice provide momentum. The challenge is execution. Can African leaders resist short-term rents in favour of long-term transformation? Can governance institutions deliver accountability? Can communities be partners rather than victims?

Africa’s bid to control the green value chain is both urgent and overdue. The opportunities are real: billions in investment, industrial upgrading, and a chance to rewrite the rules of global trade. But so are the risks: stranded assets, environmental harm, and a new resource curse.

The continent stands at a crossroads. As the world rushes toward net zero, Africa must decide whether to remain a supplier of raw materials or to seize this moment to industrialise, innovate, and build prosperity on its own terms.

Critical minerals present a once-in-a-generation chance. The question is whether Africa will take it.

Contributor at Energy Transition Africa, focusing on the future of energy across the continent.

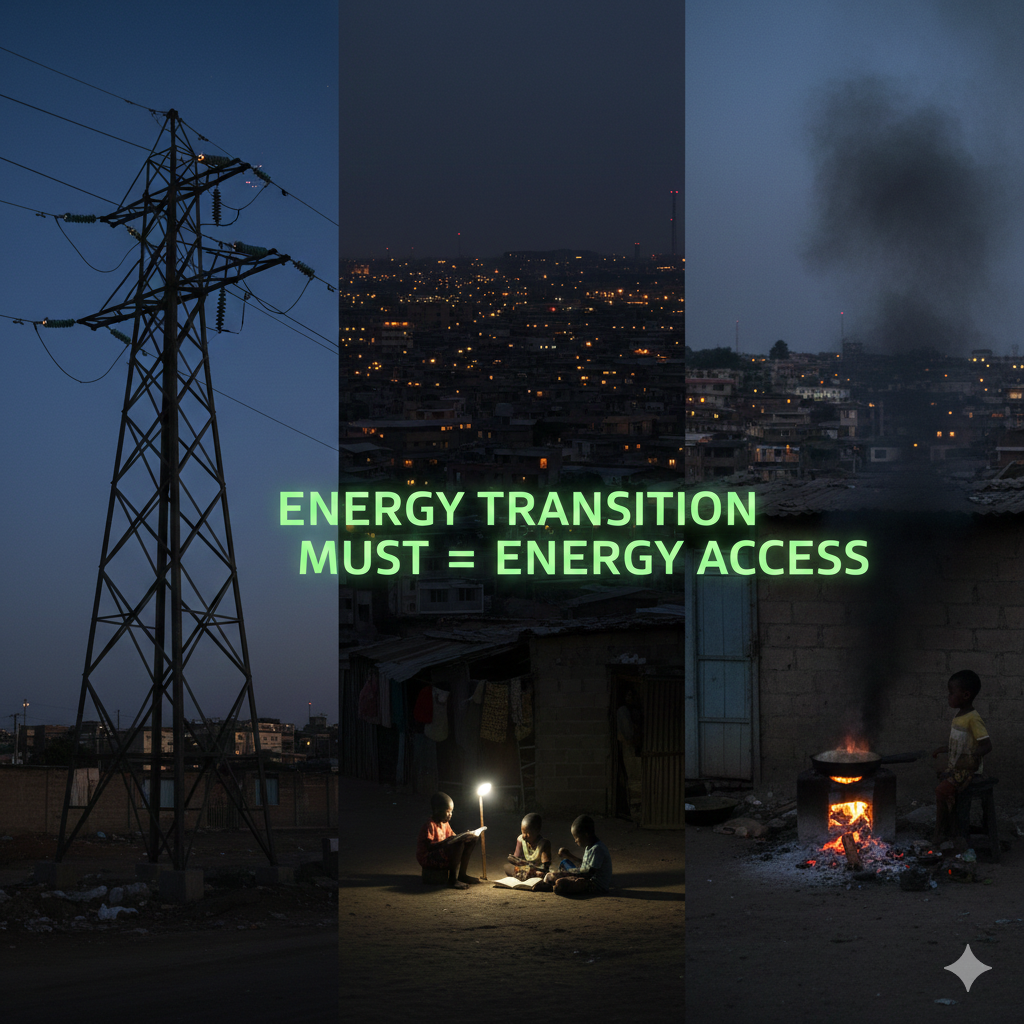

There is a phrase that has followed Africa through almost every global climate forum in recent years: “clean energy for people and planet.” And it sounds inclusive, moral and hard to argue against....