The Price of Power: Why Africa’s Clean Energy Future Still Depends on External Money

For much of Africa, the diesel generator has become an unspoken pillar of the economy. It powers factories when the grid fails, keeps hospitals running during blackouts, and underwrites commercial...

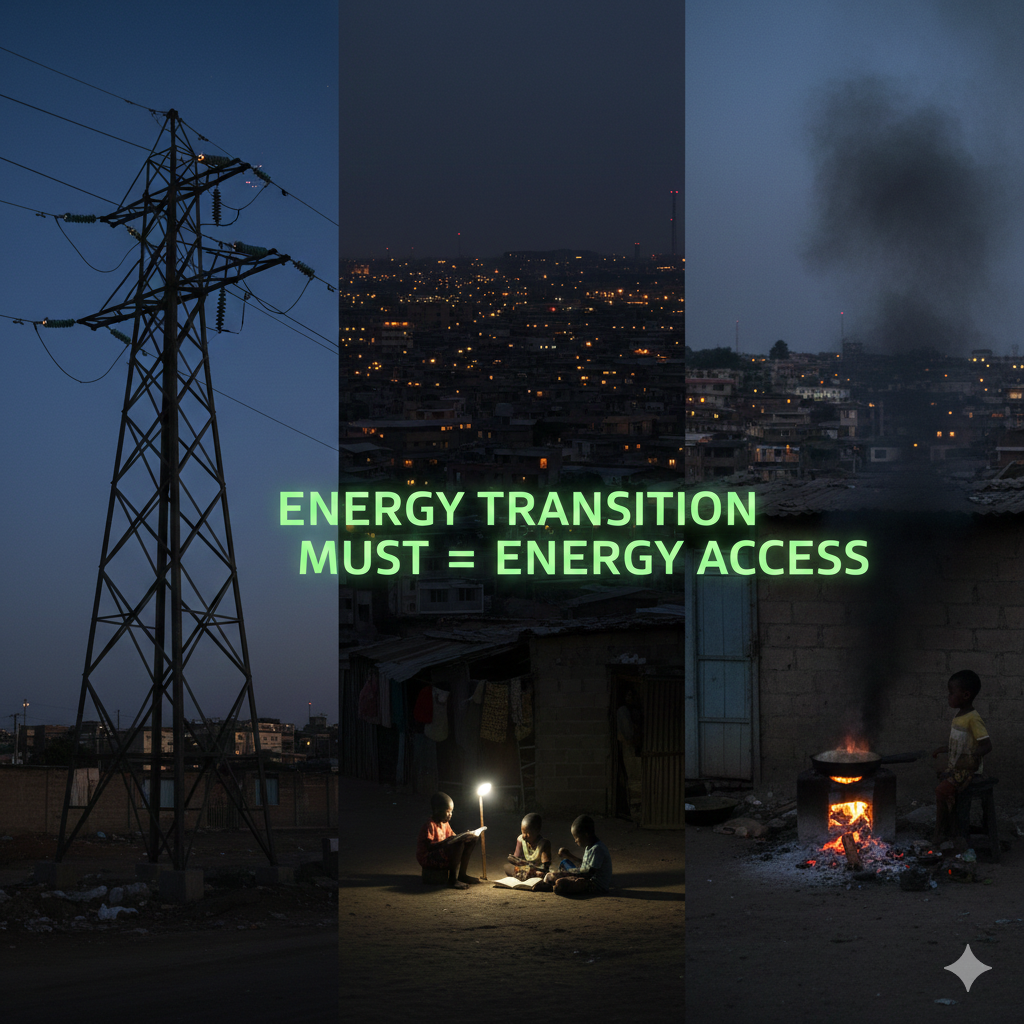

There is a phrase that has followed Africa through almost every global climate forum in recent years: “clean energy for people and planet.” And it sounds inclusive, moral and hard to argue against....

That line has lingered in my mind ever since I read the European Commission’s latest press release announcing €545 million in new funding for Africa’s clean energy transition.

President Ursula von der Leyen unveiled the package at the Global Citizen Festival, describing it as “an important milestone in scaling up renewables in Africa.”

It was the kind of announcement that earns applause: big numbers, inspiring rhetoric, a promise of progress. Yet beneath the optimism, a more sobering truth remains: Africa’s clean energy revolution is still being written, priced, and financed abroad.

According to the European Commission, the €545 million Team Europe package will expand renewable generation, strengthen grids, and extend rural electrification across ten African countries, from Côte d’Ivoire and Cameroon to Somalia and Mozambique.

On paper, it’s a milestone. In practice, it repeats an old pattern.

The announcement does not specify how much of the fund will be allocated as grants versus loans, or whether the financing will be in euros or the local currency. These details matter more than headlines admit. A concessional grant can empower; a euro-denominated loan can quietly entrench dependency.

This is not cynicism; it’s experience. African governments and developers have long accepted loans denominated in foreign currencies, only to see their costs rise as local exchange rates depreciate. Each depreciation widens the gap between what is owed and what can be paid.

So when I read “€545 million for clean energy,” I see both opportunity and a question mark: at what price, and on whose terms?

Across the continent, energy ministries dream of solar fields and wind corridors, yet the financial scaffolding beneath them is alarmingly fragile.

Take a typical solar project in Nigeria or Kenya. The financing arrives in dollars or euros, but revenues come in naira or shillings. When currencies weaken, as they often do, debt repayments balloon. Tariffs cannot simply rise overnight; households already pay more than many can afford. Developers either renegotiate or default.

The International Energy Agency notes that Africa’s cost of capital for renewables is two to three times higher than in advanced economies, driven largely by currency and political risk. The technology is not the barrier; the financing architecture is.

That’s the paradox of Africa’s green boom: we have the sun, the wind, the ambition, but we pay the world’s highest price for clean energy.

Europe’s new package comes through its Global Gateway strategy, framed as a partnership rather than aid. The language has evolved, but the structure hasn’t entirely changed.

Money still flows from the North to the South, guided by external priorities and guarded by external oversight.

Africa needs investment, urgently. But dependence on euro and dollar-denominated loans exposes countries to volatility they cannot control. In 2024 alone, many African currencies lost between 10 and 25 per cent of their value against major currencies. Every percentage point means millions more owed on climate-related debt.

This is what I call the price of power: even when the electrons are green, the money behind them remains colonial in design.

The same week as the EU announcement, Sustainable Energy for All (SEforALL) and the African Energy Efficiency Alliance (AEEA) launched a partnership to promote energy efficiency. It’s an encouraging initiative; saving energy is often cheaper than generating it.

Yet here too, much of the funding, expertise, and technology comes from outside the continent. The partnership’s headquarters, consultants, and research pipelines remain largely European or American. African institutions are often “implementing partners,” not agenda-setters.

I celebrate these collaborations; they bring visibility and momentum. But I also recognise the deeper truth: Africa’s clean energy story is still being told in someone else’s accent.

If this moment is to mean more than another round of well-intentioned dependency, Africa must build its own architecture for financing the transition. That begins with three shifts.

Africa’s oil era promised prosperity. It delivered dependence.

For decades, fossil fuels paid salaries, built roads, and funded budgets — until the next price crash. Nigeria’s 2014 recession, Angola’s IMF bailouts, Mozambique’s debt crisis — all were symptoms of the same structural weakness: revenues without resilience.

If we replicate that model under a green banner, the results will be the same.

In my essay Fossil Fuel Revenues in Decline: Who Pays for Africa’s Transition?, I warned that the window for fossil rents is closing. Unless new fiscal models emerge, Africa will swap oil dependency for climate-finance dependency.

That is not transition; it’s transformation deferred.

Let’s consider the numbers again.

€545 million from Team Europe sounds enormous. Spread across ten countries and dozens of projects, it averages just over €54 million per country, barely the cost of a single mid-sized solar farm.

Meanwhile, Africa’s energy investment needs are estimated at $190 billion per year to meet universal access and climate targets.

So yes, Europe’s announcement matters. But it’s a droplet in an ocean of unmet financing, and a reminder that Africa cannot build its future on donor milestones alone.

The real challenge is not whether Africa will transition; it must, but whether it will do so on its own terms.

We can be grateful for Europe’s support while still demanding reciprocity:

The continent’s renewable potential is vast. But the value chain of power, financial, technical, and political must begin to loop inward, not outward.

When I think about Europe’s €545 million pledge, I see two stories.

One is about generosity, a continent extending a hand to another. The other is about continuity, a world still financing Africa in foreign languages, under foreign laws, with foreign guarantees.

The first story earns applause. The second demands accountability.

Partnerships like these remain vital, but their impact will be stronger when built on shared ownership and locally anchored finance.

Contributor at Energy Transition Africa, focusing on the future of energy across the continent.

For years, the global energy transition has been narrated as a linear story: renewables rise, fossil fuels fall, and gas fades as a temporary bridge. That story is now colliding with reality. In late...